Special discount offers may not be valid for mobile in-app purchases. Actual prices for paid versions are determined based on the version you use and the time of print or e-file and are subject to change without notice.

Irs e file extension 2016 free#

TurboTax Free Edition ($0 Federal + $0 State + $0 To File) is available for simple tax returns only and has limited functionality offer may change or end at any time without notice. Try for Free/Pay When You File: TurboTax online and mobile pricing is based on your tax situation and varies by product.Printing or electronically filing your return reflects your satisfaction with TurboTax Online, at which time you will be required to pay or register for the product. Satisfaction Guaranteed: You may use TurboTax Online without charge up to the point you decide to print or electronically file your tax return.(TurboTax Free Edition customers are entitled to payment of $30.) Excludes TurboTax Business. If we are not able to connect you to one of our tax professionals, we will refund the applicable TurboTax federal and/or state purchase price paid. We will not represent you before the IRS or state agency or provide legal advice.

Irs e file extension 2016 professional#

Audit Support Guarantee: If you receive an audit letter based on your 2021 TurboTax return, we will provide one-on-one question-and-answer support with a tax professional as requested through our Audit Support Center for audited returns filed with TurboTax for the current tax year (2021) and the past two tax years (2020, 2019).100% Accurate Expert-Approved Guarantee: If you pay an IRS or state penalty (or interest) because of an error that a TurboTax tax expert or CPA made while providing topic-specific tax advice, a section review, or acting as a signed preparer for your return, we'll pay you the penalty and interest.(TurboTax Online Free Edition customers are entitled to payment of $30.) Limitations apply.

TurboTax Free Edition: $0 Federal + $0 State + $0 To File offer is available for simple tax returns only with TurboTax Free Edition.The interest and penalties will seem like nothing compared to the late filing penalties. To be perfectly clear, a tax extension gives you more time to file your return, but not to pay your taxes.įile even if you don't have the money The final point I'd like to emphasize is that you should always file your return on time, or request an extension, even if you don't have the money to pay. In the previous example of a $1,000 balance that's a year late, you would owe $30 in interest and $60 in penalties, unless you get it waived. Unlike interest, the late payment penalty can be waived if you can show good cause for not paying on time. The late payment penalty is assessed in addition to interest and is 0.5% of any unpaid tax for each month or partial month it remains unpaid, up to a maximum of 25%. So, if you owe $1,000 and pay a year after the deadline, you'll owe $30 in interest. The IRS's interest rate can vary, and is 3% for underpayments as of the first quarter of 2016.

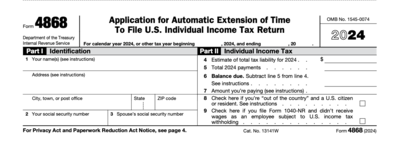

You will owe interest on any tax not paid by the normal due date, even if you have a legitimate reason for not paying on time - such as being out of the country or some other hardship. You don't need to justify the extension - all you need to do is to provide an estimate of your 2015 tax liability using the information you have and file the form by the regular tax deadline, which is April 18, 2016. While this is technically an application process, the extension is granted automatically in most cases. Here's what you need to know about applying for a tax extension, as well as a big warning about what a tax extension doesn't do.Īn IRS tax extension is automatic By filling out IRS Form 4868, you can apply for an additional six months to file your income tax return. Fortunately, the IRS has made the process of requesting an extension pretty easy.

Follow him on Twitter to keep up with his latest work!įollow year, many Americans need some extra time to finish their tax returns, for one reason or another. Matt specializes in writing about bank stocks, REITs, and personal finance, but he loves any investment at the right price. Matt is a Certified Financial Planner based in South Carolina who has been writing for The Motley Fool since 2012.

0 kommentar(er)

0 kommentar(er)